Mon to Fri: 9:00am to 5:00pm

Best Business consulting

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Mon to Fri: 9:00am to 5:00pm

8A Rochford Way, Girrawheen WA 6064

FEATURES

ABOUT US

Focus Taxation and Accounting Pty Ltd is one of Western Australia’s premier accounting firms conveniently located in Girrawheen and Belmont ,Perth just off the Beach Road, Girrawheen and Belgravia street, Belmont. We are Registered Tax Agents and public accountants; this gives us the authority to handle our valued clients’ tax affairs and accounting matters as directly and promptly from our desk. We deliver quality professional services to businesses and individuals with a personal approach, because we believe each of your requests is different and they deserve the best accounting solution especially designed for them.

CRAETIVE SERVICES

We understand that every business is unique. Our solutions are crafted to align with your specific goals,

ensuring a personalized approach that suits your needs.

Why Choose Us

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Recent CASE STUDIES

Years of Experience

Team members

Successful Projects

Satisfied Clients

Testimonials

I'm so happy with service I used them about 12 years my company and my personal very professional and friendly thanks Anwar and fateha.

J & B

I have had Focus Taxation looking after my business & personal taxation and accounting for several years.Fateha is very thorough and keep all my business safe.Since they have been looking after my business, I have not had a single query or audit request.I feel secure with their services.I am happy to endorse Focus Taxation as a reliable and professional Tax and accounting service.

Harry Langdon - Director.

In Depth Investigations Pty Ltd has used the services of Focus Taxation and Accounting Pty Ltd since 2011. We have always received the highest quality of professional services from the team at Focus. They display a vast knowledge of accounting and taxation rules and their problem solving abilities, fast and efficient services is always of a high standard which is most helpful to our needs.We have no problem in recommending their services and look forward to a long association with this company.

Bob Colton, Director of In Depth Investigations Pty Ltd.

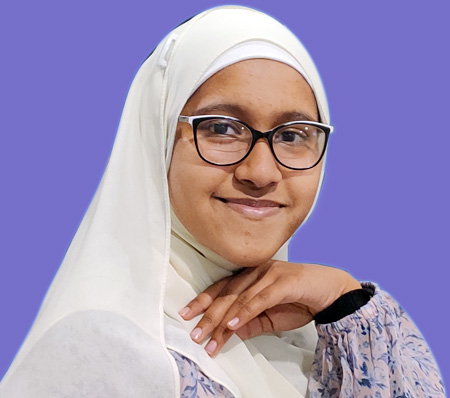

TEAM MEMBERS

Principal

Director

Technical Director

Software Engineer

Manager-Marketing

Part time Office Assistant

Franchisee

Accountant Brisbane

Franchisee -WA South of River

Franchisee

1763699683.jpg)

Franchises , WA

Accounting provides a clear picture of a business's financial health, facilitates budgeting and planning, aids in tax compliance, and enables better decision-making by stakeholders.

The main financial statements include the Income Statement (Profit and Loss), Balance Sheet, and Cash Flow Statement. These statements provide insights into a company's profitability, financial position, and cash flow.

The deadline for individual tax returns in Australia is usually October 31st. However, this may vary, so it's essential to check the current tax year's deadlines.

Individuals earning income above a certain threshold, self-employed individuals, and those with complex financial situations are generally required to lodge a tax return in Australia.

Deductions can include work-related expenses, charitable donations, medical expenses, and more. It's crucial to keep accurate records and consult with a tax professional for specific details.

STP is a reporting system introduced by the Australian government, requiring employers to report salary and wages, PAYG withholding, and superannuation information directly to the Australian Taxation Office (ATO) during each payroll cycle.

STP streamlines payroll reporting processes, reduces the reporting burden on employers, and enhances the accuracy and timeliness of information reported to the ATO.

Superannuation provides financial security in retirement, potential tax advantages, and may offer insurance coverage through the fund.

Businesses with an annual turnover of $75,000 or more (or $150,000 for non-profit organizations) are required to register for GST.

FAQs

Latest Blog

If your business uses Xero (or any of the other excellent payroll packages available), you may have seen Payroll changes rolling out for each of the various stages of Single Touch Payroll (STP). The final stage of the rollout includes the requirement to track additional data around paid leave ( Stage 3).

Focus Team

1st Jan 2024

In the 2016–17 Budget, the Government announced an increase to the tax discount for unincorporated small businesses incrementally over 10 years from 5 per cent to 16 per cent.From 1 July 2016, the tax discount will increase to 8 per cent,

Focus Team

11th Jan 2022

Government announces increased taxbenefits in response to the Coronavirus.The Government has announced its economic response to the Coronavirus in the form of a $17.6

Focus Team

12th Jul 2021

Explore our services conveniently from your home. Whatever you need, we're just a click away. Start now!